The Sprint to Last-Mile Grocery: Examining the E-Grocery and Delivery Landscape

Grocery Pedro Ramos

Pedro Ramos

Customers' increasing desire for speed, convenience, and contactless grocery shopping options is driving a huge surge in third-party delivery and eGrocery usage. What was once new and uncommon is now becoming an expected shopping option, especially as pandemic-related lockdowns and social distancing protocols become more and more common. In a rush to offer online ordering and home delivery, many grocers are turning to third-party vendors to help ramp up their capability to meet customer expectations.

In our recent webinar with Supermarket News, Market Expands for E-Grocery Delivery Players, we reviewed the incredible growth of grocery delivery and last-mile delivery. Below are highlights of the webinar we conducted. The discussion featured valuable insights from Tory Gundelach, Senior Vice President of Retail Insights at Kantar Retail and Bill Bishop, Chief Architect at Brick Meets Click, and our very own Pedro Ramos, VP of Sales at Agilence, .

Third-party e-grocery delivery landscape

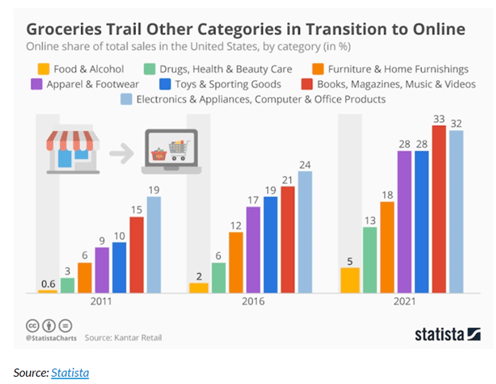

According to one survey, the Food Marketing Institute estimates that online grocery sales will reach $100 billion by 2025, or about 20% of the grocery retail market. Online purchases of food and alcohol have been a category that trailed other categories in online sales, waiting for a catalyst to spur their growth.

The pandemic was the catalyst the industry needed to transition to online sales, with an incredible increase in grocery delivery in the third quarter of 2020, based on Incisiv’s Grocery Digital Maturity Benchmark 2020, a survey of over 90 grocery brands indicated that the following methods were used to deliver online grocery purchases.

- Instacart – 37%

- Amazon – 23%

- Direct from grocer – 23%

- SHIPT – 10%

- Other 3rd party – 7%

The survey also examined why consumers choose grocery delivery over curbside pickup or in-store shopping. Over half (51%) of consumers indicated they desired fast delivery, from same-day arrival to less than an hour, over a third (37%) desired a favorable time slot preference, and a quarter (27%) liked the product availability, assortment, and variety that grocery delivery offered. Shoppers also showed a preference for continuing online grocery purchases and delivery not just for the pandemic but would continue.

Because of the COVID-19 outbreak, sales from grocery delivery and pickup dramatically increased in 2020. Sales in March 2020 grew to $4 billion, a 233% increase over August 2019’s total of $1.2 billion. Similarly, sales grew 80% from March to June where they topped out at $7.2 billion before declining to $5.7 billion in August 2020.

What does it mean to be a last-mile grocery provider?

The mix of players and partnerships in the grocery delivery space is quickly evolving. Instacart, the current leader in the grocery delivery sector, partners with brands across the US. A smaller competitor, Shipt, owned by Target Stores, is also a provider in this space, but new players are emerging that serve both large, mid-sized and smaller independent grocers.

DoorDash and UberEats, which previously focused on restaurant-only delivery, is now moving into the grocery delivery space. Similarly, grocery chains are now evolving by offering ready-to-eat meals and are easily served by DoorDash and UberEats last-mile delivery for customers desiring a quick meal, often in 30 minutes or less.

At the same time, grocery brands are evaluating the economics of third-party (3P) grocery delivery over their own (1P) delivery systems. Online orders are inherently more expensive than traditional in-store purchases, an extra expense that an industry with razor-thin margins cannot always afford. Brands like Walmart are experimenting with 1P full assortment delivery, allowing customers to expand beyond traditional grocery orders.

In that light, some brands are choosing to develop alternative grocery delivery services. Some are using local delivery companies or are investing in technology to improve delivery while driving down costs, according to Bill Bishop.

The lines between last-mile grocery delivery, restaurant delivery, and full assortment delivery, in addition to who performs that last-mile delivery will continue to blur as brands develop new hybrids that fit the geographic area and customer market they serve.

Who are the last-mile leaders?

Instacart is currently the leader in last-mile grocery delivery. While Instacart does not publish its revenue numbers, estimates indicate that they earned over $3 billion in 2019, but had yet to see a profit until April 2020. Instacart has over 500,000 shoppers, an increase of 284% over 2019’s estimate of 130,000 shoppers who support an estimated number of 5.5 million grocery delivery users, a 2019 estimate.

Shipt, owned by Target Stores, reported in May 2020 that sales through their service grew 300% year over year. Rosie, a 3P delivery service catering to independent grocers, reported an increase of 900% since the start of the pandemic.

DoorDash is the most used restaurant delivery service, citing an increase of 21% of consumers using the service between January and May 2020. According to Tory Gundelach and Kantar Research, the restaurant delivery service volume increased by 123%. But due to the blurring lines of restaurants and ready-to-go meals from retailers, 63% of grocery shoppers are very or somewhat likely to order a sandwich from a retailer, indicating that this sector will see even more growth.

A compelling factor separating these two delivery leaders is the length of time it takes to deliver an order. The average time for Instacart grocery delivery is 2 hours, as opposed to 30 minutes for a restaurant order.

However, Bill Bishop believes that the Amazon Fresh hybrid model of brick-and-mortar stores along with distribution hubs will challenge the current models, pushing them to challenge current delivery methods and time frames. In the meantime, Shipt, Doordash, Postmates, FreshDirect, Ubereats, and even independent players will create new market models.

Comparing Third-Party to home-grown online delivery

Instacart and other 3P delivery providers are expected to position themselves to serve a growing online need for grocery, restaurant, and full assortment delivery. Tory Gundelach stated that 90% of customers use multiple methods to purchase products and the in-store, curbside, and delivery models must support those customer needs as it continues to be a complex issue to address.

The 3P delivery market may see shakeups as competitors like DoorDash compete with Instacart, as well as continued merger activities in the delivery sector. DoorDash is the current competitor to keep an eye on for the future.

However, grocers will be looking to develop their own 1P delivery services that allow them to exert more control over the buying experience and delivery process. We expect larger retailers to rely less on partnerships with 3P providers, especially in markets where it makes sense for them to efficiently expand their own last-mile delivery operations.

While online grocery orders are expensive for the retailer, they must also examine additional delivery fees to the customer. While click-and-collect will be the predominant online grocery method because of the fees, there will probably be market fragmentation when it comes to fulfillment. Part of this issue is that delivery services are typically available in larger metro areas, while the opportunity for outlying areas is present, it must be cost-effective for the store and customer.

Bill Bishop cites that traditionally, the delivery fee of $10-$12 was affordable to those households who desired convenience, but if brands can leverage technology to streamline delivery, and lower the cost to $3 per order, it will be a win-win for 1P providers and their customers.

Pros and cons for retailers partnering with third-party delivery

Retailers are battling the opposing trends of customers who had poor online shopping experiences and those who liked it and are willing to give it more business. But improved services require more investment as these organizations battle increased competition in a changing marketplace, forcing all players to examine the pros and cons of grocery delivery.

Pros of Third-Party Delivery

Quickly Scale Delivery Capabilities

Grocers who offer online shopping can partner with 3P partners to provide last-mile delivery, allowing them to quickly scale and meet the growing volume of online shopping volume. They can also deliver to customer locations where it would be inefficient to deliver as a 1P provider. According to Bill Bishop, “it’s zero cost and zero CAPEX” for retailers to scale their delivery system quickly.

To address emerging delivery issues, retailers will look to following Amazon’s model and work with logistics partners for variations on last-mile delivery, outsource to independent delivery operators, or create an ecosystem by leveraging technology to create their own delivery management software. The growth of the Amazon Fresh store and platform that focuses on delivery from hubs and hyper-fast delivery to build capacity. This will create new competition, value, and shopping alternatives for customers.

Accessibility

Online shopping and delivery allow retailers to reach new markets for customers who don’t or can’t shop in-store, expanding their reach within existing markets. Hypothetically, they could also combine more deliveries to individual customers from multiple stores, which is not the norm currently.

This model also allows customers access to stores and offerings they might not have access to in their local area, opening up new product and service offerings.

Tory Gundelach indicted a surprising jump in the number of seniors who started using grocery delivery, with the height of all delivery in June 2020. Overall, online shopping has increased 36% in 2020 over 2019. During this time, people have gotten over their learning curve and became familiar with online grocery shopping and delivery. The demand for this service is expected to stay high, but not continue the huge, triple-digit growth that occurred in 2020.

Gundelach also stated that prior to the pandemic, the shopper was different. These consumers were typically very high-income households who were short on time and willing to pay for the convenience of delivery. The other end of the spectrum were low-income customers, often the elderly, or minorities in urban areas who did not have access to grocery stores. Millennials are often still picking up groceries but do like the convenience of delivery too. More consumers of all demographics are now enjoying the convenience and selection of online grocery shopping and delivery.

Customer convenience could incrementally increase sales

Convenience is the primary reason that customers have flocked to online grocery purchases and delivery. Convenience is no longer just for the high-end customer, but also for those who want to save time and increase accessibility to new brands, all at a reasonable cost.

The average spend per cart is higher with Instacart orders, allowing retailers to incrementally increase their sales. As shown by the increase in sales to a height of over $7 billion in sales in June 2020, this added convenience (and safety) drove customers to increase their online buying habits.

Cons of Third-Party Delivery

Branding and Customer Experience

While customers are still more loyal to store brands than delivery services, the lines get blurred during the ordering process. Grocers are unable to control the customer experience when using an Instacart or 3p app, losing exposure to their brand.

Retailers desperately want to improve their customer experience while 3P delivery services want to ensure that customers keep using their service. However, we can expect to see more innovation in this area. For instance, in a call with Yummy.com leadership, Bill Bishop cited that they now promise to deliver groceries within 30 minutes or less and 10 minutes or less pickup, a dramatic competitive edge in their Southern California market. It is customer innovations like this that will raise the bar for the rest of the industry in terms of customer experience, convenience, and brand exposure.

Barclay’s Investment bank found that 43% of Instacart users indicated that in the event that their preferred grocer was unavailable on the Instacart platform, they would switch to another grocer on Instacart. This type of platform loyalty is of concern, yet a reality, for grocers who partner with 3P providers.

Finally, if the customer has a negative online shopping and/or delivery experience, it is often the retailer who will typically receive the complaint, even if the issue were attributable to the 3P provider. That is why it is important for retailers and 3Ps to efficiently partner to resolve complaints that can impact both of their reputations.

Data

Retailers depend upon customer data to analyze trends, drive procurement, and expand their brand. But they need transaction data to do this, something they often lose when customers order through a 3P app. Instacart and 3P companies leverage this data to differentiate their product and service offerings, but grocers and retailers also need this data to take creative control of the customer experience.

Core competency and profitability

According to Bill Bishop, delivery is not in the core competency of retailers, which is why they outsource it to 3P providers. Last-mile fulfillment has its challenges that need to be navigated and by those who have the logistics expertise that 3P providers offer.

In addition, creating a last-mile logistics organization is expensive and something that grocers are not willing to incur as a capital expenditure. As expensive online orders grow and profitability decreases, the additional CAPEX expenditures just are not viable for many grocery organizations.

Can this data be integrated with in-store POS data to get an overall view of sales?

Pedro Ramos of Agilence shared that grocery brands are approximately one-third of their customer base as they seek the value of data analytics. Agilence’s goal is to put actionable data in the hands of grocers and retailers so they have enhanced insights for making better decisions.

Can 3P purchase data be integrated with in-store POS data for a holistic view of sales? The answer is yes, and Agilence works closely with grocers to isolate 3P transactions for improved visibility.

When grocers have access to their 3P transaction data, they have improved pricing visibility for insights on pricing power within the store. They use this information to better understand price and margin optimization to improve margins.

This data can also be leveraged to get visibility of category and item movement to ensure in-stock positions and even suggest private brand substitutions. One of the problems with 3P delivery partners is lack of access to transaction data and Agilence works with brands to isolate the impact that 3P purchases have on stock positions.

Agilence has also identified potential fraud issues, including a recent instance where 3P shoppers were using their personal loyalty cards to gain points from customer purchases. Additional fraudulent activities uncovered included purchasing gift cards for personal use and identifying other types of shopper fraud.

Data analytics has never been more important for improving the customer experience in an expanding and competitive online marketplace. These insights help grocers identify the true impact of 3P partnerships and create actionable insights that benefit the brand and its customers.

Looking to the Future

Our presenters all agreed that the growth in online grocery shopping and delivery will continue to increase for the foreseeable future, but we are not likely to see the triple-digit increases and mass adoption we saw during the height of the pandemic. Consumers have become accustomed to shopping this way and are likely to continue, continuing the mix of in-store, curbside, and home delivery grocery options.

Related Articles

The New Shopper: Changes to Grocery Shopping Behaviors Post-Pandemic

Before the COVID-19 pandemic, grocery shopping kept to a familiar pattern, which meant that shopping behavior was fairly pred...

The Staggering Impact of Grocery Shrink and How to Fight Back

Every retailer deals with shrink – product loss from various sources like theft and damage. But unlike clothing or electronic...

Getting to Know the Online and Third-Party Grocery Customer

While the vast majority of grocery shoppers still prefer to buy in store, the Food Marketing Institute estimates that online ...Subscribe to our blog

Receive free educational resources like exclusive reports, webinars, and industry thought leadership articles straight to your inbox.