Tackling Total Retail Loss: A New View on Loss Prevention

Retail Pedro Ramos

Pedro Ramos

For the last 100 years, retailers have used the term “shrink” to indicate the difference between what is on the shelf as compared with what is in inventory counts. Shrink is often synonymous with loss, which may also include errors like mispricing or inaccurate data, or waste. But a century ago, no one would ever have imagined the complex supply chains, omnichannel shopping alternatives, loyalty programs, and intricate web of processes it takes to operate today’s retail operations, yet the concept of retail shrink and loss has stayed virtually the same.

As retail operations evolve, so does the need to re-think how we categorize “loss”. No longer just the difference between products on the shelves and inventory management system reports, retailers must expand their concept of loss to reflect their entire retail environment.

What is Total Retail Loss?

Professor Adrian Beck joined forces with the Retail Industry Leaders Association (RILA) in 2016 to propose the concept of “Total Retail Loss” in his 2016 paper, Beyond Shrinkage, Introducing Total Retail Loss. In 2019, Professor Beck and RILA published a follow-up piece titled, “Total Retail Loss 2.0: Moving Beyond the Theory” to explore the retail industry’s adoption of the concept and ways to overcome the challenges to adoption and tips on getting started. Professor Beck outlined how today’s retail operations have numerous opportunities for loss throughout their operations, but until they implement the Total Retail Loss (TRL) concept, their losses will continue to eat away at profits.

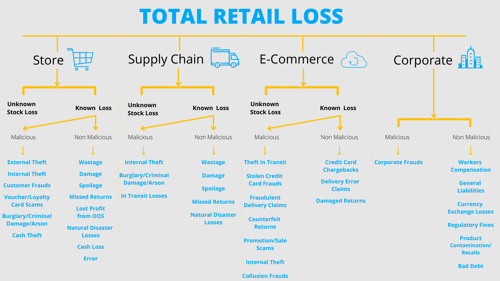

The 2016 report on TRL included 33 categories of loss, from store theft to corporate fraud but has since been updated to offer 42 categories of loss to account for more losses associated with E-Commerce and other digital channels. It also differentiates between “costs” that retailers incur in the normal course of business versus “losses” that reduce profits. The goal of TRL is to better understand current and future loss prevention risks so retailers can make targeted operational investments that improve the bottom line.

Retailers can now analyze loss across the entire organization from internal and external perspectives, from store level, supply chain, corporate, and vendor operations. What’s changed? It’s not that loss never happened at the corporate, supply chain, or store level before, but now retailers have access to the diverse data and applications that can more easily measure and reveal where the loss occurs.

How are retailers affected by TRL?

Total Retail Loss recognizes that loss happens across all business units, including store operations, management, supply chain operations, IT, and more. The TRL approach identifies the total amount of loss across all operations so actions can be taken to recognize, address, and reduce loss.

Addressing loss across the organization requires two things: top-down executive-level support and the willingness of business units to work together to measure TRL and implement processes to reduce it. The traditional approach to loss prevention was to isolate it into a separate LP business unit that prioritized crime-related loss. Focusing on malicious loss only looks at part of the picture. Using the TRL approach broadens the concept so more teams can work together to understand systemic loss.

Defining Loss

Professor Beck distinguishes between retail “losses” and “costs” using the TRL approach:

Costs: Expenditure on activities and investments that are considered to make some form of a recognizable contribution to generating current or future retail income. Example: Compensating a disgruntled customer for a price discrepancy may be seen as a cost of doing business with the hopes of securing their future business.

Losses: Events and outcomes that negatively impact retail profitability and make no positive, identifiable, or intrinsic contribution to generating income. Example: Customer or employee theft.

In his interviews with senior retail executives, Professor Beck noted that “costs” are something leaders can plan for using managed, measured, and meaningful insights. As one executive noted, “measurement is key and you can’t measure a mystery”. Measuring Total Retail Loss is critical to identifying and preventing it, requiring retailers to draw upon the extensive data that they already own.

No matter where the loss occurs in the retailer's organization, the TRL approach breaks down loss into categories that include "known or unknown" and if known, then "malicious or non-malicious". Malicious loss needs proactive prevention steps while non-malicious loss might be reduced through process-improvements and longer-term problem-solution programs.

By adding known and unknown elements to store operations, retail supply chain, e-commerce, and corporate types of loss, Professor Beck defined 42 categories of TRL. These classifications note only loss types. Costs are not included in this model.

Specifically identifying the types of loss that occur within the retail organization is the first step to reducing it. Traditional loss prevention programs are familiar with most of these 42 categories, but it is the TRL holistic view that brings them all together, allowing retailers to focus their time and resources.

How do you measure TRL?

As Professor Beck interviewed retail executives, they understood that unless the loss is measurable, it is difficult to understand the organizational impact. The TRL concept addresses that loss can be measured in multiple ways, including loss of assets, cash, and margin -- all impacting the business’ profits. Professor Beck includes over a dozen types of losses to calculate, including pricing errors, delivery errors, insurance claims, stock liquidations, and vendor charges, helping organizations reveal the extensive opportunities to measure TRL across retail business units.

Tips for Implementing a Total Retail Loss Approach

The 2019 “Total Retail Loss 2.0” report showed that the concept of TRL had gained significant awareness among loss prevention professionals since the publication of the original report, with almost 9 in 10 respondents aware of the concept (with 64% of those believing TRL had some impact in their organizations), and more than half stating that they’ve either fully embraced the concept or adopted at least some of its elements into practice.

However, one common concern was a lack of guidance on how to introduce the concept to the wider business, and so Professor Beck and the team at RILA outlined 12 key factors to consider in TRL adoption efforts.

1. Get the C-Suite on Board

Adopting the TRL methodology in your retail organization takes top-level commitment to resolve loss issues by measuring, managing, and taking enterprise-wide steps to correct them. With TRL, loss prevention is no longer the responsibility of a single LP business unit but requires ownership across the entire company.

2. Develop a Business Case – Focus on the Size of the Prize

Loss prevention teams are uniquely positioned between merchandising, store operations, supply chain, and other functions within the organization to own the implementation of a concept like TRL. They typically also have access to much of the data required to analyze the impact of TRL. Using the access to this data, leaders should focus on outlining the financial benefits expected through the adoption of a TRL-based methodology.

3. Adopt an Incrementalistic Approach to TRL

The philosophy of TRL should be treated as a long-term business strategy that can be customized and implemented gradually over time rather than an “all at once, all or nothing” approach.

4. Identify Quick Wins First

Quick wins can go a long way in gaining organizational buy-in. Focus on those areas that can be expected to delivery successful outcomes early on and build momentum from there.

5. Organize for Utilizing TRL

Determine who will be held accountable for delivering the quantifiable benefits of the TRL-driven approach and what resources will be required to support related organizational goals.

6. Advocate for TRL – Act as Agents of Change

Ensure that those driving TRL-related activities act as “agents of change” – collecting data, prioritizing work, and recommending improvements to those best positioned to deliver whatever is required to move these efforts forward.

7. Review Reporting Structures for TRL

Historically, there has been very little standardization on lines of reporting across the loss prevention industry. However, given the scope of TRL initiatives, coordination with those in Finance or with financial backgrounds will be well suited for cooperation.

8. Prepare for Organizational Antagonism

Given the wide depth and breadth of efforts across organizational functions required to implement TRL, it often has the potential to cause territorial strain due to a perceived “land grab” by those driving the TRL agenda. It’s imperative that those driving these efforts make an effort to take pre-emptive actions to explain, reassure, and support all parties involved.

9. Think about the “Right” Name for your TRL

While the term “Total Retail Loss” has become fairly well-known in the LP world, it’s important that organizations develop their own name for their TRL-inspired initiatives, customized for their goals and context. For example, transitioning to “Profit Protection” is a common moniker used to describe what TRL-inspired efforts are aiming to achieve.

10. Avoid Terminological Confusion

Beyond the high-level name for TRL-initiatives, all terminology must be clear, focused, and easily understood by all parties involved. For example, “shrinkage” can continue to be used as a proxy for unknown stock loss, but make sure that there is a distinction made between that and the broader loss picture being developed.

11. Use TRL as an Analytical Lens

In addition to applications managing retail losses, the TRL concept can also be used in a more focused way to evaluate the likely impact of any planned innovation and change by a business. This kind of comprehensive impact assessment model can be used to calculate a balanced ROI for any given innovation or retail change.

12. Remember Timing is Key

As is the case with most decisions both personally and professionally, timing is a key factor in determining success. A TRL initiative should be introduced when people are most likely to be receptive, when other priorities align, and decision-makers are both open to and invested in change.

Measuring and managing loss is enhanced by bringing together diverse data points from across the organization. Using the TRL Typography of 42 categories, organizations use a data-driven approach that identifies the type of loss while capturing data that provides unique insights.

The retail environment is dynamic, and every dollar counts. Agilence can work with you to implement data analytics solutions that identify specific areas of loss and improve profits, committing to be your partner as you explore new opportunities to protect assets and improve margin.

Recently, Agilence teamed up with Loss Prevention Magazine on a research report aimed at measuring the changing perceptions and value of Loss Prevention teams. Responses were collected from a hundred LP professionals at every level, operating in various industries. Download your free copy of the full report today to see the results.

Related Articles

Retail Shrink and the Complexities of Known and Unknown Loss in 2022

Retailers have long struggled to minimize shrink. The term itself has been around for more than 150 years, but in that time, ...

Operations and Loss Prevention: Working Together to Reduce Shrink

While often thought of as two separate teams, retail operations and loss prevention (or asset protection) teams have signific...

Loss Prevention Stats and Facts Every Retailer Should Know in 2022

With the welcome influx of in-store customers and growing sales volume, retails still need to keep a watchful eye on loss pre...Subscribe to our blog

Receive free educational resources like exclusive reports, webinars, and industry thought leadership articles straight to your inbox.